Driving New Business

Year: 2018

Duration: 3 months

Role: Product Designer

Team: Content Writer, Customer Recruiter, Design Engineer, Project Manager, 3 fellow Product Designers

Tools Used: Pencil & Paper, Sketch, Invision, Zoom/Teams

Summary:

Mortgage provider Mr. Cooper wanted to grow new business through their mobile payment app. Representing the digital product team, I consulted with IDEO to design new mobile finance features that maximize and reward customer engagement.

We conducted consumer research, identified high-value opportunities, tested via prototypes, and ultimately delivered designs for a self-service tool which allows customers to calculate their potential savings and refinance their home loan, keeping customers engaged, and growing new business all through the mobile app.

Background

When I joined Mr. Cooper, the product team had spent the last few months partnering with IDEO to make the most of their mobile payment app. Customers primarily used the app to track and pay their mortgage.

How might Mr. Cooper leverage this monthly engagement to grow new business and introduce existing customers to new products?

And in an industry known for predatory consumer practices, how might Mr. Cooper build trust through offers which genuinely benefit customers?

Research

Qualitative Interviews:

We interviewed 30 Mr. Cooper customers in various US markets to benchmark their personal finance understanding and home ownership goals.

Some of our findings:

Many customers “feel like a number”– they had no say when their mortgage was sold to or bought by Mr Cooper.

For most customers, real estate finance is unfamiliar and intimidating. Many have experienced or are recovering from debt-related struggles, and others never formally learned the personal finance “basics”, leading to general risk-avoidance.

For most customers, their home is their most valuable asset. With such high stakes, the benefits must be worth it.

We identified several business opportunities with substantial benefits to customers:

Debt Consolidation

Home Loan Fast Track

Home Snapshot

Home Loan Refinance “Tune-Up”

Video Glossary

Product Design

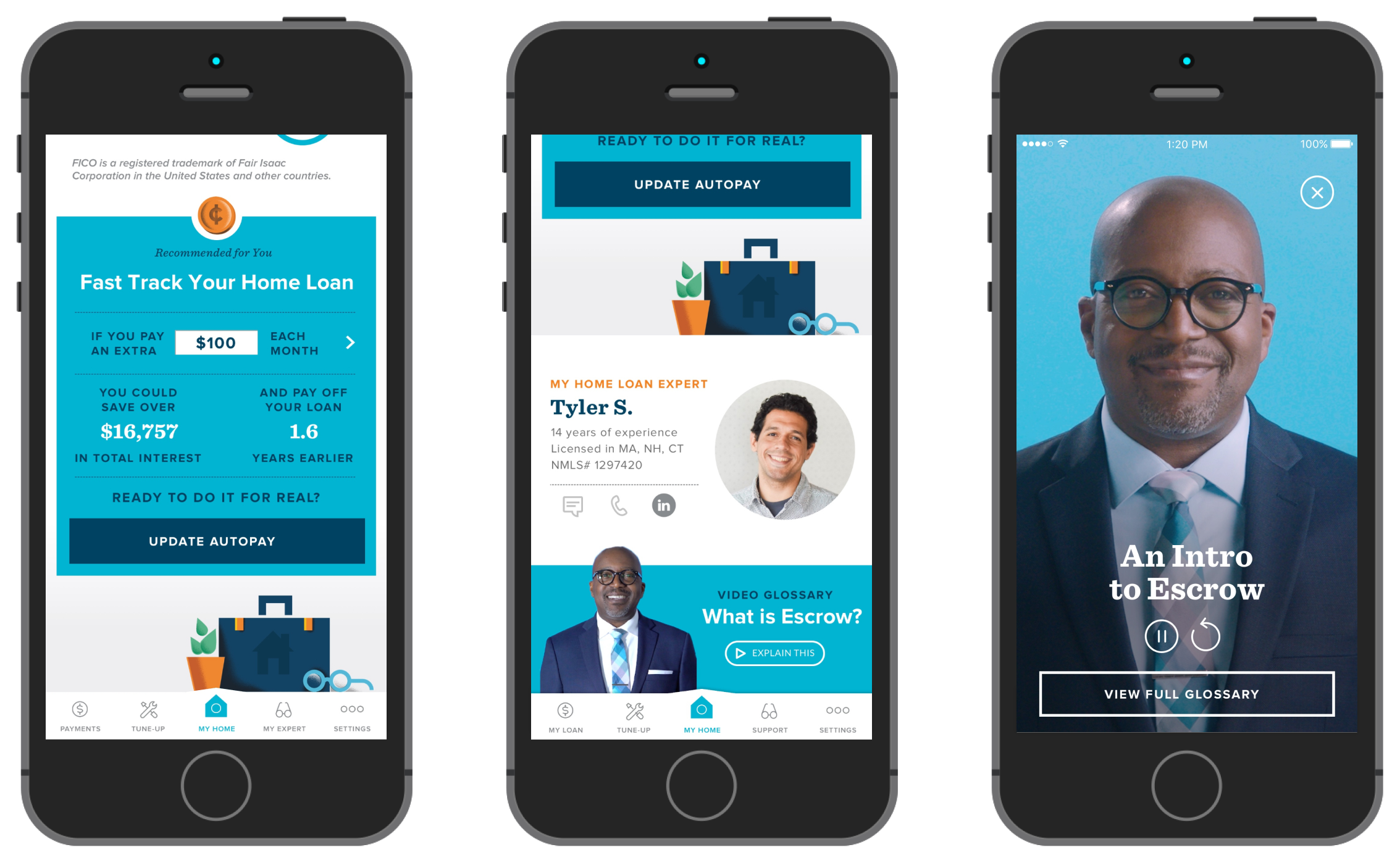

I worked closely with the teams at Mr. Cooper and IDEO, reviewing our findings to align on the highest priority business opportunities: Home Loan Refinance “Tune Up”, Home Snapshot, and Video Glossary.

I then joined the IDEO team in synthesizing our research, generating concepts, and designed interactions to support the following principles surfaced from our interactions with mobile mortgage customers.

Product Design Principles:

Provide Immediate Value to All Customers

Home Snapshot: Personalization “feels like home.” Customers can select a custom avatar and review useful property data like neighborhood stats, economic trends, current equity, and valuation.

FICO score: This has to be provided for certain customers, why not provide it to everyone?

Offer Real Benefits

Refinancing should only be offered to users who it helps

Transparency First

Help users understand the pros and cons up front - communicate proactively around potential concerns like credit score, so that customers understand their credit won’t get dinged

Clarify the benefits - to customers AND Mr. Cooper

Include disclosures as recognizable tooltips, so information is readily available without overwhelming users

Provide resources so users can answer their own questions

Show and Tell: Demonstrate outcomes in context through interactive charts, quizzes, and calculators, so that customers gain better financial understanding while exploring offers even if they ultimately don’t refinance their home

Reward Engagement

If customers DO want to refinance, ensure qualified agents are immediately available to assist them

Launch-to-Learn Pilot

To test our hypotheses and improve the experience, IDEO teammates and I built hi-fidelity prototypes and conducted 10 Launch to Learn pilot sessions to validate our evolving Tune-Up designs. Users at a variety of technical levels were invited to explore the flows as they would in-app and describe their experiences using a talk-aloud protocol. We also surveyed participants to benchmark their sentiments toward Mr. Cooper before and after testing, along with their overal perceptions of transparency, value, and trust.

The Results

While the features were not immediately implemented due to financial market changes, we successfully delivered principled and trust-driving features to drive future business through increased customers engagement. Our work and deliverables provided valuable insights for Mr. Cooper to guide ongoing customer initiatives and product development.